ET: What To Expect

The goals of this project are education and inspiration.

Like in the book, Factfulness, most people are surprisingly misinformed on the basic facts of the energy transition, or unaware of the great companies taking it on (education). And from an investment perspective that creates a major opportunity (inspiration).

The target audience is both private and professional investors, as well as those working on or interested in the energy transition/climate change. I will start, for the first few months, by looking at history – trying to understand how we got here, to better inform ideas about how things might proceed.

The history of energy transitions has seen us go from human muscle power to animals to industrial products to technology, with heat, light, and energy coming first from wood, then coal, oil, and gas. As the population has grown, we have overcome all energy and nutritional challenges by making applications more efficient and moving to greater production of more energy dense fuels.

We are now in the middle of another great energy transition. This time, two things are different. Firstly, climate change is imposing a natural accelerant to the transition, as humanity generally seeks to move away from the system (fuels and uses) that is causing it. Secondly, we are not moving to a more energy dense physical fuel, but from commodity to technology. Oil, gas, and coal, to solar, wind, and batteries. That means that countries and regions need entirely new systems of generating, delivering, and using electricity, and investors need new mental models to understand it.

One of those new models is the S-Curve, which describes the growth pattern of technologies with learnings curves (where they get cheaper as capacity expands, creating a feedback loop). This was never true of oil and gas, which typically gets harder and costlier to produce as demand grows. Solar, wind, and batteries are growing at unbelievable rates because they are reached performance and price parity with their competition. Identifying which technologies are following an S-curve and which are not (there aren’t many!) is critical for investors, as it explains why those will take over the world, while others (e.g. hydrogen and carbon capture) can do very little to save us.

The Human Learning Curve

There are many misconceptions about the energy transition.

People often don’t realise how far solar, wind, and EVs have already come in certain places, or at the global level. Many people also don’t realise why: because of their falling costs and consequently rapid deployment.

A second one is that people tend to think we need some kind of as-yet unimagined major technological breakthrough – the silver bullet fallacy. In reality, we have most of what we need to get most of the way, and what it will take is a great mix of different things in different places.

A third one comes from the green movement, which believes in divestment and Net Zero absolutism, which would only lead to higher energy prices and inflation, and further pressure on the poor and emerging markets, leading to more global strife.

Or, people think that this is a costly burden, forced upon us by politicians. The reality is it is the private sector driving it now. Equally, some of the geopolitics of energy will also change, as China becomes an energy superpower for the first time, every nation discovers local sources of clean power, and the global fixation on oil reserves shifts power and attention away from historic producers.

Finally, many people don’t realise that air pollution is potentially the greatest threat to human life from the burning of fossil fuels – killing an estimated 10 million people per year (more than HIV, AIDS, and Tuberculosis combined). All these things and many more add up to one great muddle, and this project aims to use an investor’s perspective, grounded in financial reality, to show what is working, and what is driving the energy transition.

Investing in Change

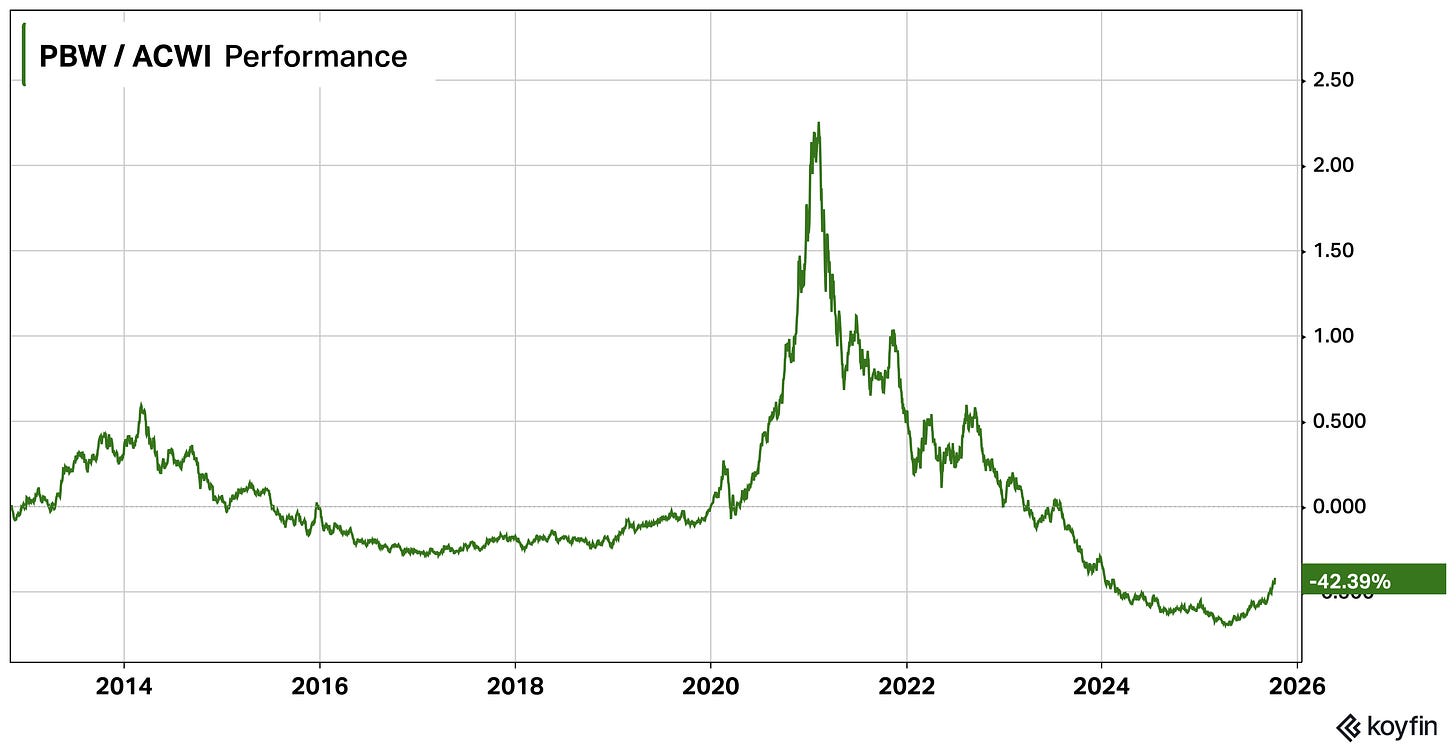

Investors love technology stocks, and have done through history – from radios and telephones to canals and railways, each has seen its respective boom as the exciting new technology. Each has seen its boom turn to bust, and clean tech is no different. In 2021, it soared seven times faster than the already impressive S&P 500 in America, before crashing back 80-90% while the index carried on rising, lifted by a new champion, AI.

Clean Tech vs The World

There are typically three phases for new innovations. First, a huge opportunity is identified, and a horde of companies are quickly launched to try and capture it. Investors get caught up in the excitement, bidding up business plans written on the backs of napkins to extreme valuations. This inevitably crashes as reality doesn’t deliver on the hype (or at least, not quickly enough, and not for everyone).

From there, many companies fail, but from the pack, the best solutions continue to gain traction in their markets and emerge as a more concentrated leadership group into the next phase: the race to market leadership. Having been wildly overvalued with little in terms of product or growth to show for it, five years on, these companies have refined and launched their products, and many are growing quickly and/or profitably.

That is where we are today, and within each of the major verticals of the energy transition, I will investigate some of those markets and their possible future leaders, as well as discussing the market dynamics and investment approaches best suited to each industry.

However, to understand where we’re going, we need to zoom out, understand the energy system as it is today, and how it came to be…

Stay tuned.

Kit

Really interesting!!