Action... Reaction!

“Climate change is much worse than you realise, but the fight against it is going much better than you think too.”

That’s what I learned to say when I started working in energy transition investment research seven years ago. I think it’s still true. Most people underestimate how bad climate change is and will get. But they also don’t realise how many brilliant people are working on effective solutions, that exist at scale and low cost, and are materially impacting global emissions already.

This project aims to be the research I wish I’d had back then. I don’t yet know everything about the energy transition, or investment, but they say you teach best what you most need to learn, so here we are.

Today’s note will talk about

Where we stand today

How to think about the energy transition

Why and where the investment opportunity exists

And it all begins with…

The ESG Antibubble

Financial markets are unsentimental. When the share prices of companies relating to climate change stopped going up, the financial world quickly stopped talking about climate change.

It had been such a huge topic. As we exited the first lockdowns in 2020, people became very excited about Environmental, Social, and Governance metrics and connected these to “sustainable investing”. Greta Thunberg was at the peak of her popularity, excitement about solutions was huge (we’d just beaten Covid - climate change was “next”), and the investment world was racing to keep up.

However, it didn’t last.

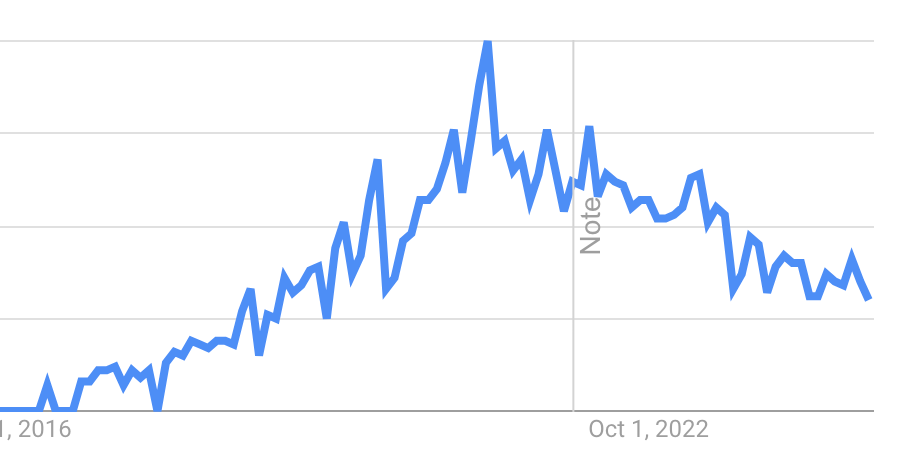

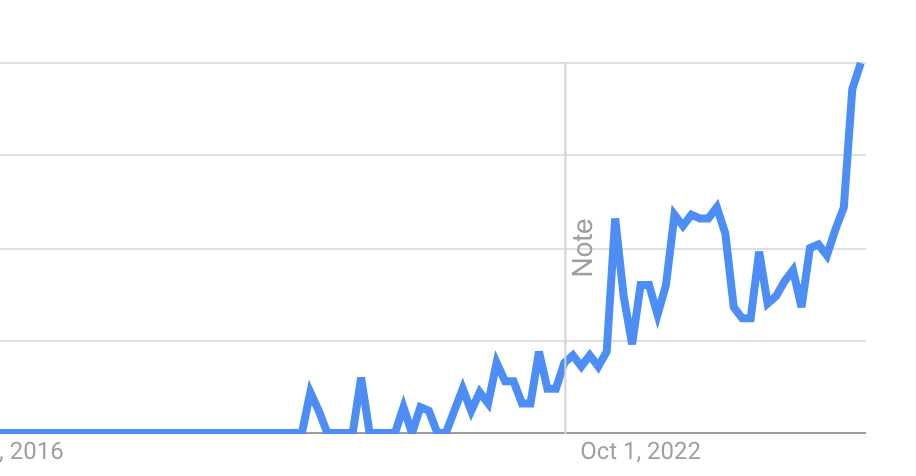

Having seen searches for “ESG investing” surge from 2016-2021, Google Trends shows that this faded in subsequent years.

Meanwhile, on the same timescale, searches for “anti-woke” took off since 2021, from very low levels:

Bubbles form when a finite amount of something – money, or attention – becomes overly concentrated in a single area. However, because the amount of money or attention is limited, attention has been sucked away from other areas – creating antibubbles. Every action is met by an equal and opposite reaction.

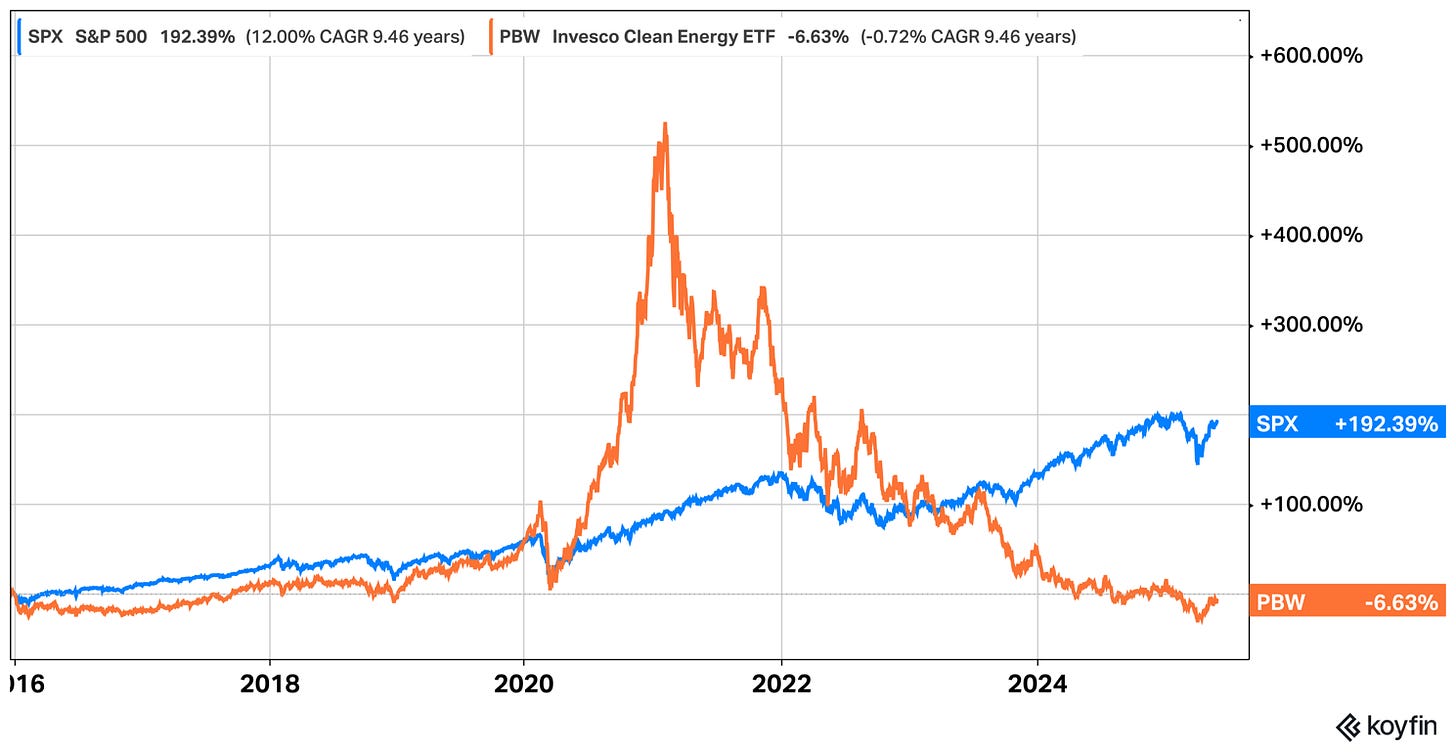

This had dramatic implications for investors. In 2021, a bubble formed in clean energy/technology stocks – linked to the broader bubble in ESG investing. However, as attention turned, so did capital, and what was a bubble became an antibubble. In other words, an opportunity. This is how the clean tech and broader index performed up to the middle of 2024.

Bubble, Burst

That’s just a price index though. The key is what’s happening with the companies involved, and the really interesting thing is that four years ago, stock prices rose almost entirely on hope – hope that confused direction with speed.

Bubbles always start from a nugget of truth. In this case it was that climate change was a huge global threat, and therefore opportunity, for companies who could offer solutions to mitigate or adapt. The conclusion about the direction for such businesses was correct.

However, the great misjudgement was speed. Valuations are in some ways a discounting mechanism for future returns. The higher they go, the more of the future returns they are pulling into the present. Time is what kills bubbles – and this was true again here. The growth just didn’t come fast enough. (AI investors might be making the same error today, just as internet investors did in 1999.)

Four years on, many companies which were pre-revenue are now commercially successful. For some, growth is no longer promised, it’s proven. There has been a two-fold shift: share prices have crashed back down to earth and beyond, while some companies have started to take off commercially.

Investors are taught to get interested in growth or value, and so the rubble of a growth stock bubble is a good place to look. Before we go any further though, let’s cover the underlying driver of all this.

The Climate Imperative

Michael Liebreich, founder of leading think tank and data provider Bloomberg New Energy Finance (BNEF), says,

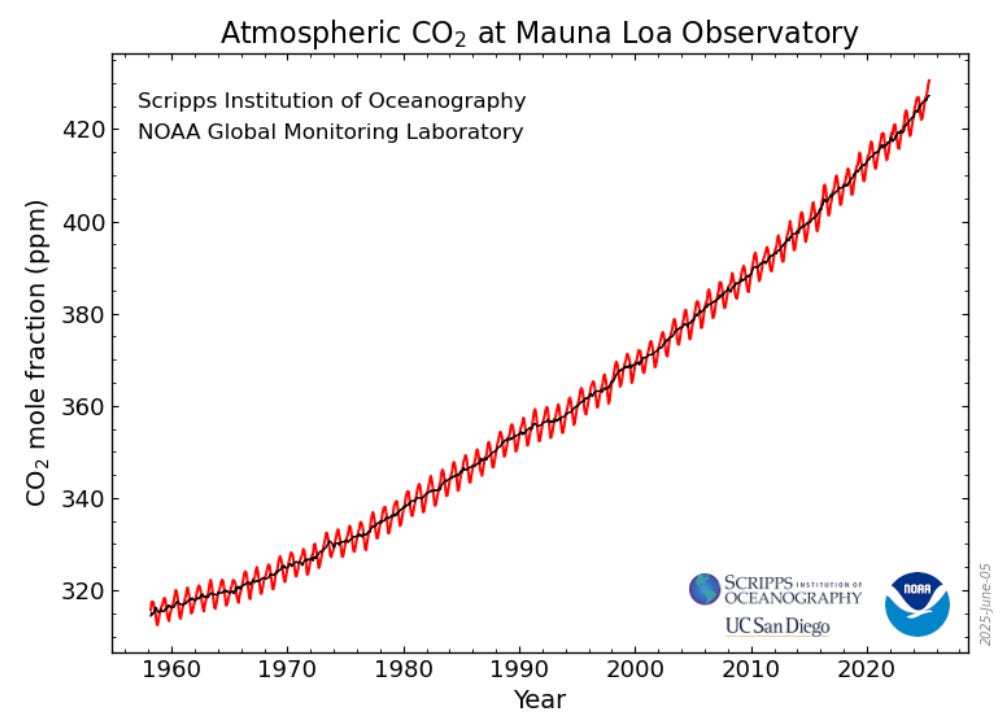

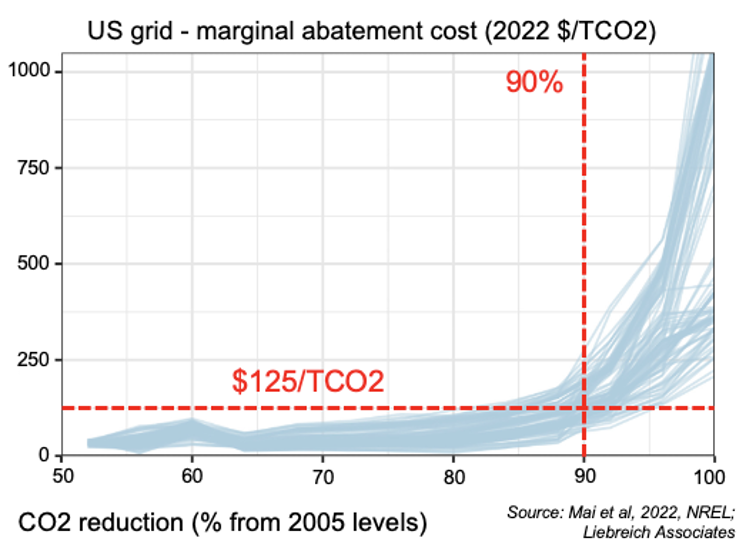

“If you want to tell the climate story in two charts it’s the Mauna Loa CO2 concentrations and the cost curves for different technologies.

- We have an urgent problem.

- Let’s fix most of it quickly and cheaply.

It’s not more complicated than that.”

Well, here they are.

Up and to the Right

The Enemy of the Good

Mauna Loa is the world’s largest active volcano, and covers half of Hawaii island. More importantly for us, the US government’s global monitoring agency there has the world’s longest record of direct measurements of CO2 in the atmosphere. They started in 1958, thanks to C. David Keeling of the Scripps Institution of Oceanography. It shows that atmospheric CO2 concentrations have risen in a steadily accelerating fashion over the last 70 years. Measurable, proven.

The second chart shows the cost curves of different technologies for reducing CO2 emissions. It reveals that the additional cost needed to decarbonise the grid to a 90% level includes numerous technologies that cost less than $125 per tonne of CO2 abated. These are: solar, wind, batteries, electric vehicles, some efficiency technologies, and a few others. Not included are almost all of the hydrogen industry, carbon capture, and obscure technologies that seem exciting but are decades away from helping to displace carbon emissions in the system.

Overall, Liebreich’s point is brilliantly clear and simple. There are many arguments about the problem, and about technologies that won’t solve it quickly or cheaply. So, he asks three questions:

“Why don’t we focus on the first 90%, and stop getting into ideological debates about the last 10%, which we are not going to reach for decades?

Why are we risking political backlash by promoting solutions today that deliver little or no decarbonisation (or even generate more emissions), but eat public finance or drive up costs to consumers and businesses?

Why are we focusing so much time, talent and money on solutions that cost hundreds or thousands of dollars per TCO2 (tonne of CO2 removed), when these are vastly out of the money until grids get to 90% decarbonised?”

The truth is that wasting time and money on solutions that don’t meet the “fast and cheap” criteria will only alienate people and endanger further progress.

One little-mentioned fact is that carbon dioxide has delayed impact and a long life once emitted. It doesn’t have much warming impact for the first 5-10 years, but then lasts for decades. Concerningly, this means the current temperature rise is mostly driven by emissions from before 2020 or so, and today’s emissions will continue affecting the climate well after 2050, even if we succeeded in getting them down by then.

When thinking about climate solutions, always keep speed and cost in mind.

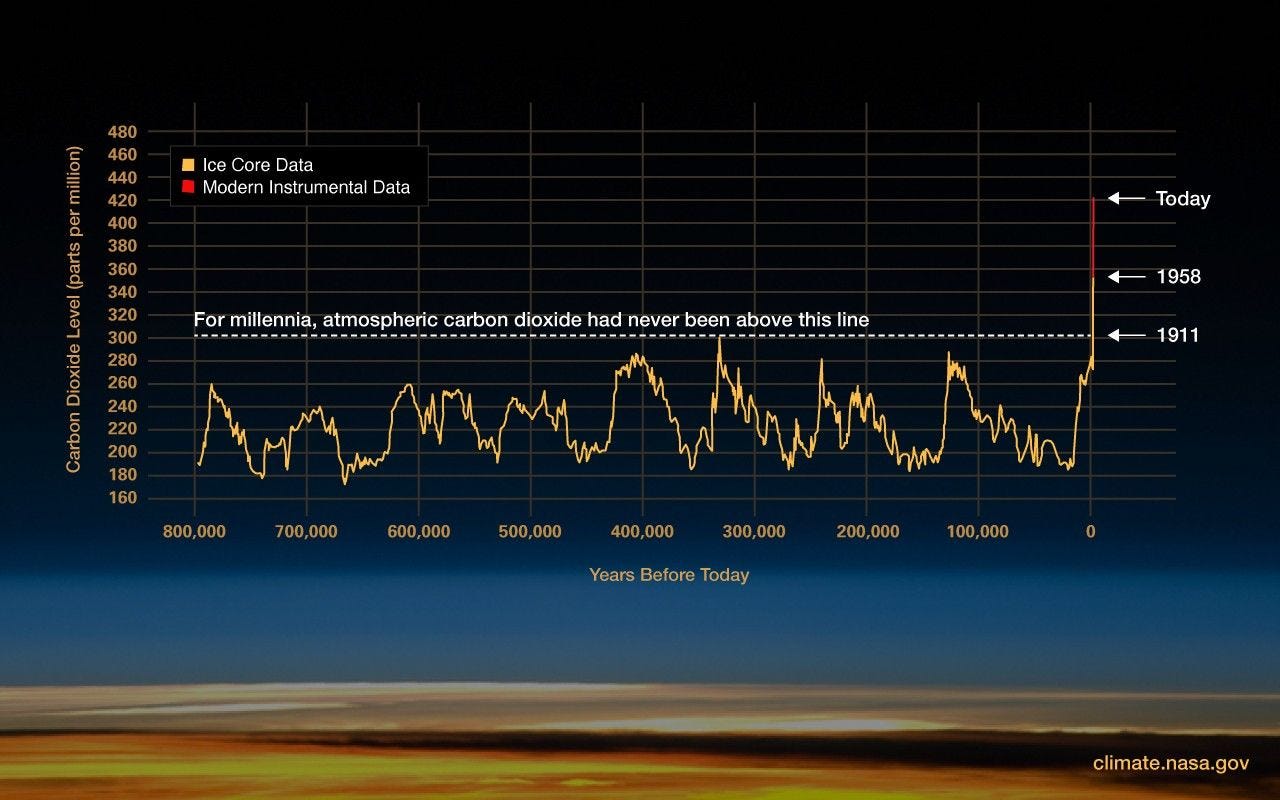

Before we move on, I would add a third chart. The steady rise of CO2 shown by the data from Mauna Loa tells the story brilliantly, but it lacks… oomph. Some people still say – well, the earth has warmed before, and it could be correlation rather than causation, and it’s not such a dramatic rise anyway.

Atmospheric CO2 levels have gone from around 280 parts per million (ppm) during pre-industrial times to 424ppm today. The last time CO2 levels were around the 400- mark was 3 million years ago. This chart from NASA places the speed of the current rise in a longer-term context, which I find more compelling.

No Connection?

There is a problem. Let’s solve it. Action, reaction!

The Investment Opportunity

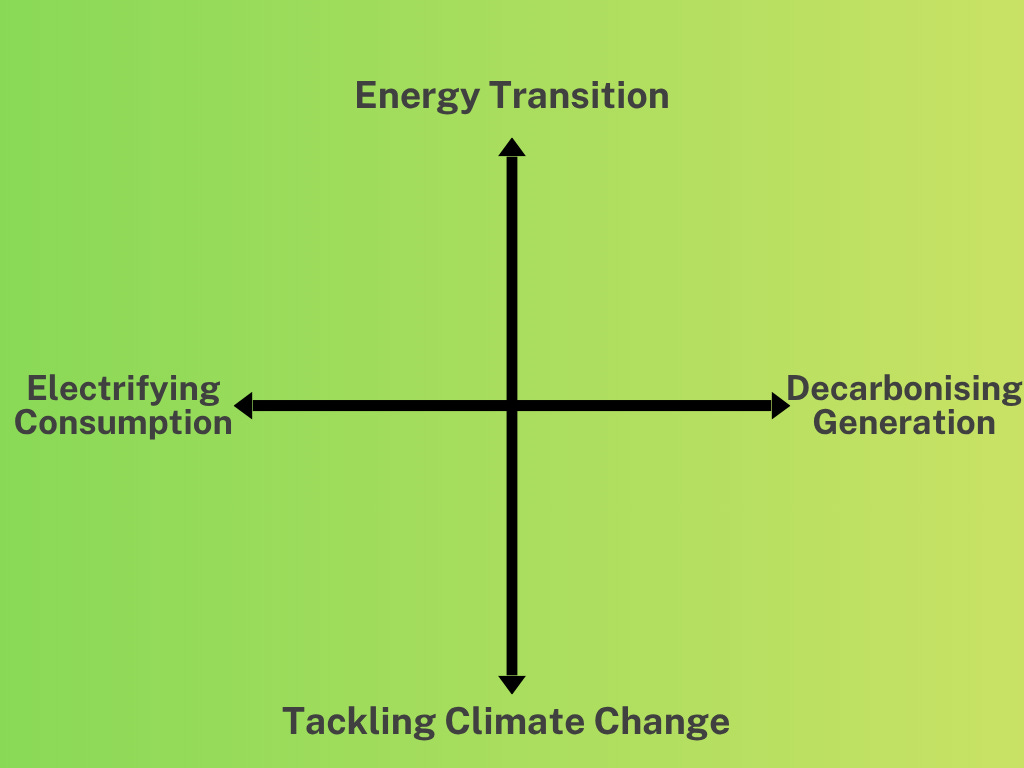

There are two separate stories here: the fight against climate change, and the energy transition. They are not the same thing. Liebreich is correct about the fight against climate change: speed and cost are the two most important factors.

Luckily, there is the energy transition. This is a separate, organic, independent trend, which is the result of economics and entrepreneurialism. It is the replacement of our commodity-based energy system with a technology-based one. The former has delivered great things but at a cost, the latter offers a better way. Economics is the key driver: cost and product-market fit will determine the winners. No moral imperative is required.

Market forces will drive success for companies which can grow quickly and cost-competitively, while creating value for share- and stakeholders by generating returns above their cost of capital. Technologies which require decades of loss-making operations, or which cannot compete on cost even at maturity, will be slowly whittled out.

The Energy Transition: Defined

ET is a broad term, and needs delineation. There are multiple trends and shifts coming together. Firstly, we must differentiate the fight against climate change, and the energy transition. The former is a moral cause that calls upon people and their governments to act, with less regard to cost, under the belief that the costs of action would be dramatically outweighed by the costs of inaction, of unhindered global warming.

The energy transition, meanwhile, is a non-moral, non-political trend in which the generation and consumption of energy is undergoing a profound shift over multiple decades, driven by economics and new technologies. It is a disruption. The energy transition is mankind’s greatest hope in the fight against climate change, but it’s important to distinguish them.

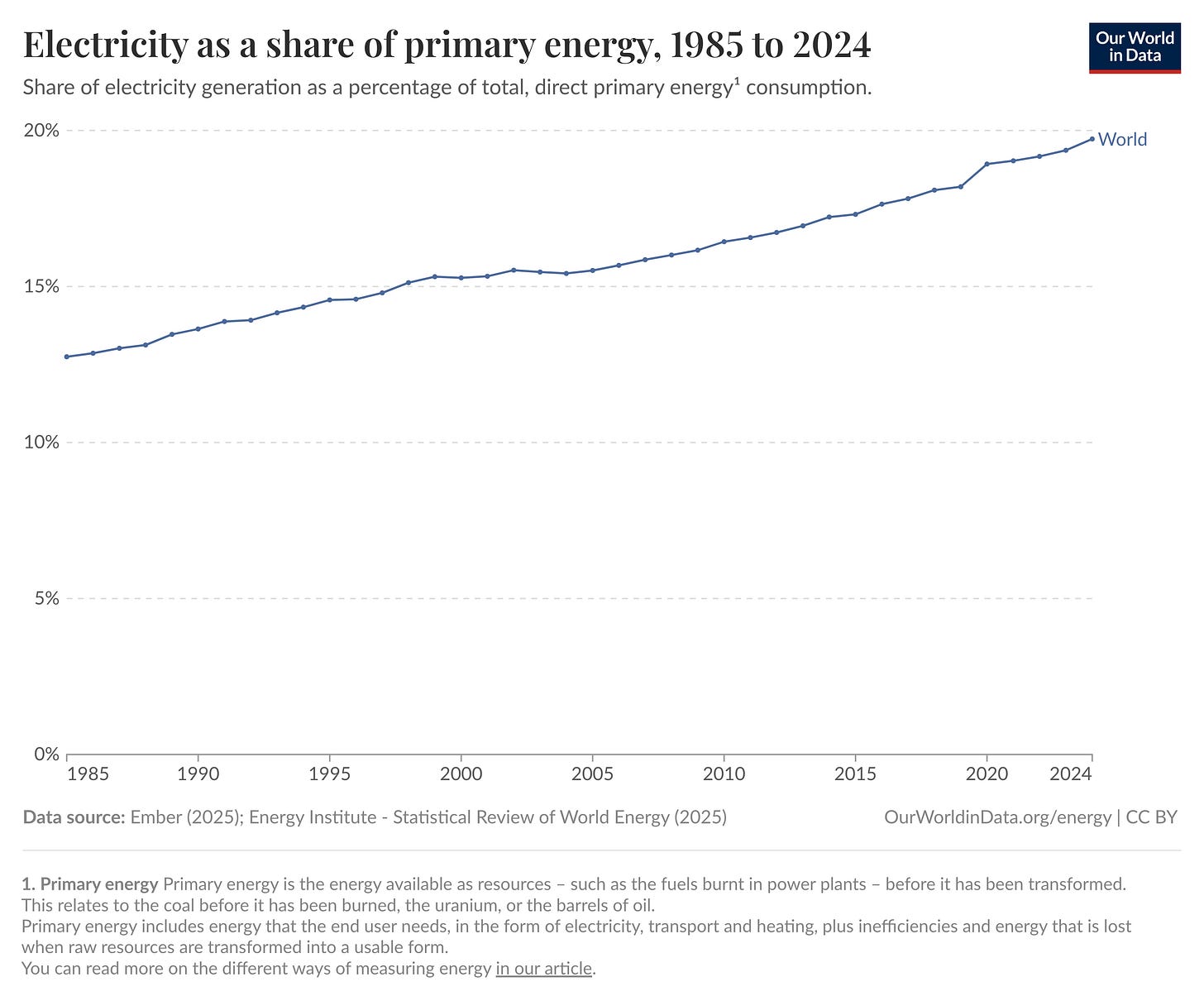

Another delineation that we must be careful to recognise is within the energy transition. This is between the electrification of global energy consumption, and the decarbonisation of global energy production. Replacing coal plants with gas, or renewable sources like solar, wind, hydro, nuclear or geothermal, gets most of the attention. This is squarely about reducing the emissions from electricity generation, the decarbonisation of electricity supply.

However, electricity only makes up around 20% of final energy demand. Gas stoves and petrol cars don’t use electricity, they burn fossil fuels directly in order to create heat or movement. Shifting from petrol to electric vehicles is part of the electrification of demand. The shift to EVs becomes more impactful, from a climate perspective, when generation is increasingly switched to low or no-carbon sources, like renewables, and mainly away from coal.

Electricity made up 9.5% of global final energy consumption in 1973, and slowly crept up to 19.7% in 2024.

Slow and Steady

Turning the tide on climate change is what free markets should deliver via the energy transition – although not in a straight line, nor without waste along the way. Expensive technologies which are slow to deploy are likely to struggle to raise capital, find customers, and sell to them at profitable prices and volumes.

For investors, what I’m interested in is identifying the companies which are growing, which are profitable, and which are likely to play a big role in the energy system of the future. One interesting element of that is the adoption of these new energy technologies.

Learning Curves and S-Curves

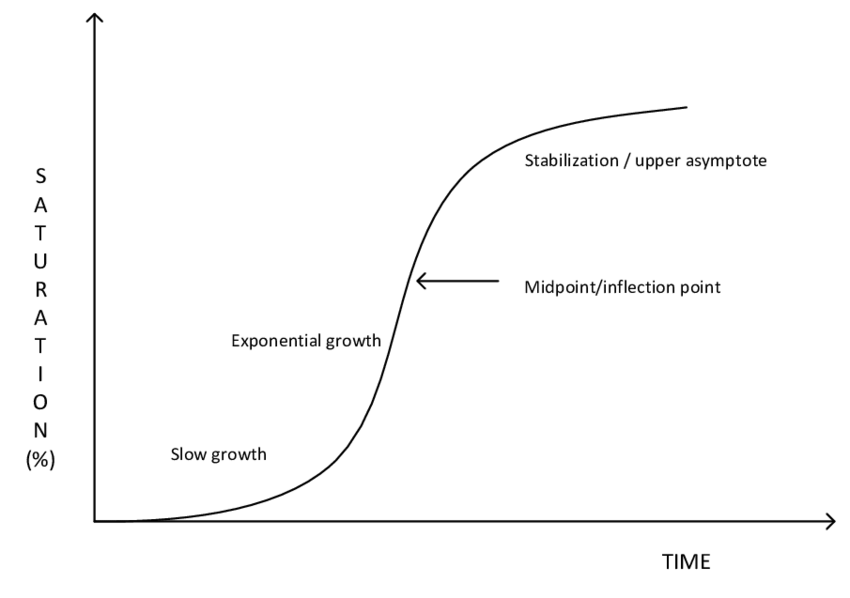

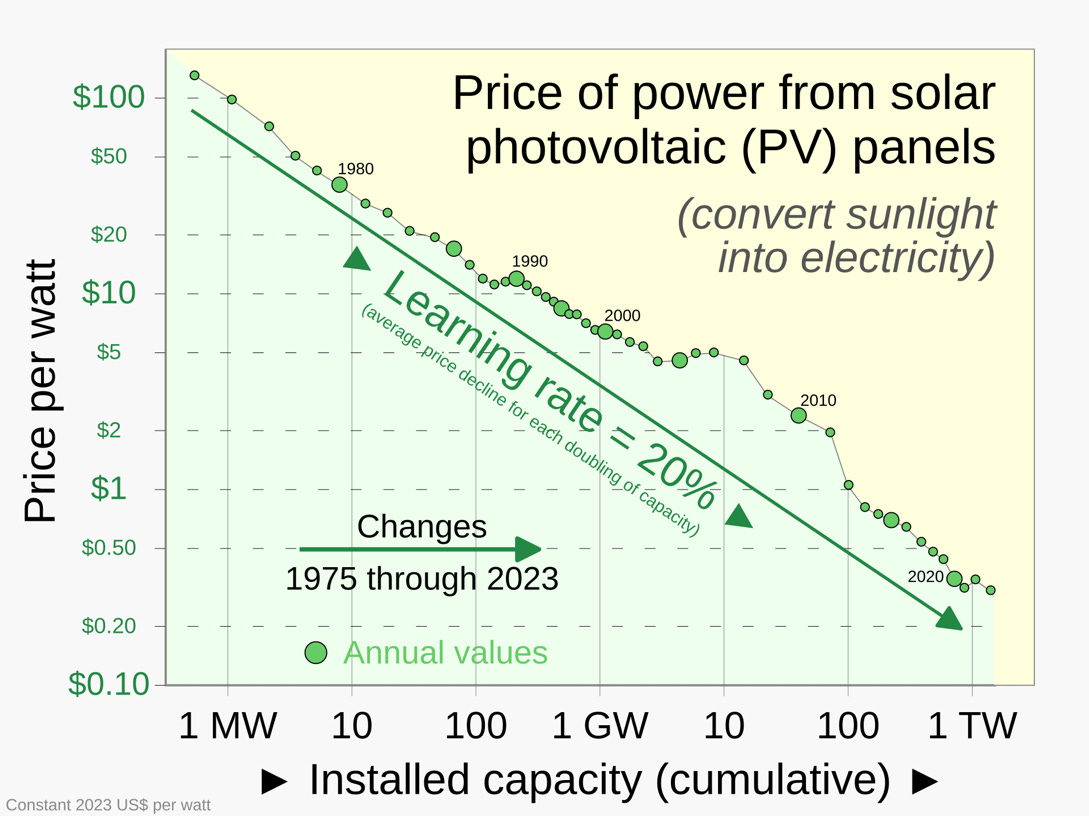

Solar, wind, and batteries have followed a “S-curve of adoption”. As modular technologies with numerous companies competing to supply the growing market, they are constantly seeking better performance at lower cost. As a result, these technologies get better over time, in line with the addition of new capacity.

This is the learning curve, or learning rate, and is what drives the S-shaped adoption curves, with accelerating growth before a slowdown and plateau (at some point).

This is the key driver of the energy transition, and a central idea for investors in this space. Some technologies follow them. Others, like most of hydrogen and carbon capture, do not. Understanding the growth patterns of certain technologies is crucial when forecasting which technologies will keep gaining market share, and which will fade.

The earliest iterations of cars, planes, computers, phones, lighting, and heating were all breakthrough technologies at the time, but had limited capabilities. Each of them has evolved through innovation and expansion over decades – fossil fuel-based technologies included.

Semiconductors are a classic example, having developed along the pathway laid out by Moore’s Law, which followed from Gordon Moore’s observation in 1965 that the number of transistors on a microchip was doubling approximately every two years. This trend has continued ever since, leading to smaller, faster, and more powerful electronic devices.

It’s natural that solar power would follow a similar trajectory, as the basic unit of a solar cell, from which solar panels are made, is a semiconductor. Specifically, they utilise the photovoltaic effect, which is the principle allowing semiconductors to convert light energy into electrical energy.

Just as with Moore’s law, each doubling of solar panel manufacturing capacity has resulted in an 18% average reduction in cost per watt.

Capacity up, price down

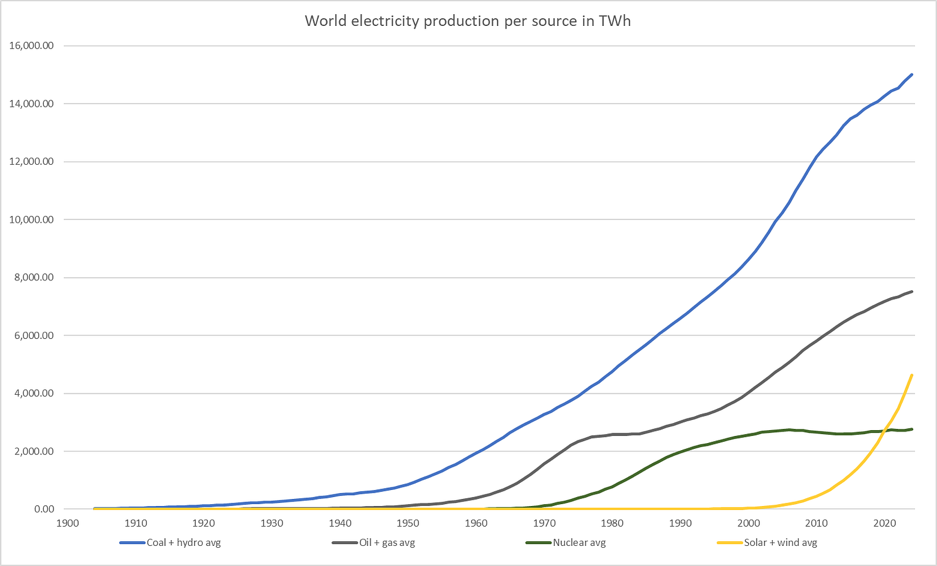

Wind power has followed a similar trajectory, and as a result, solar and wind are now gaining market share faster than any other source of energy in history.

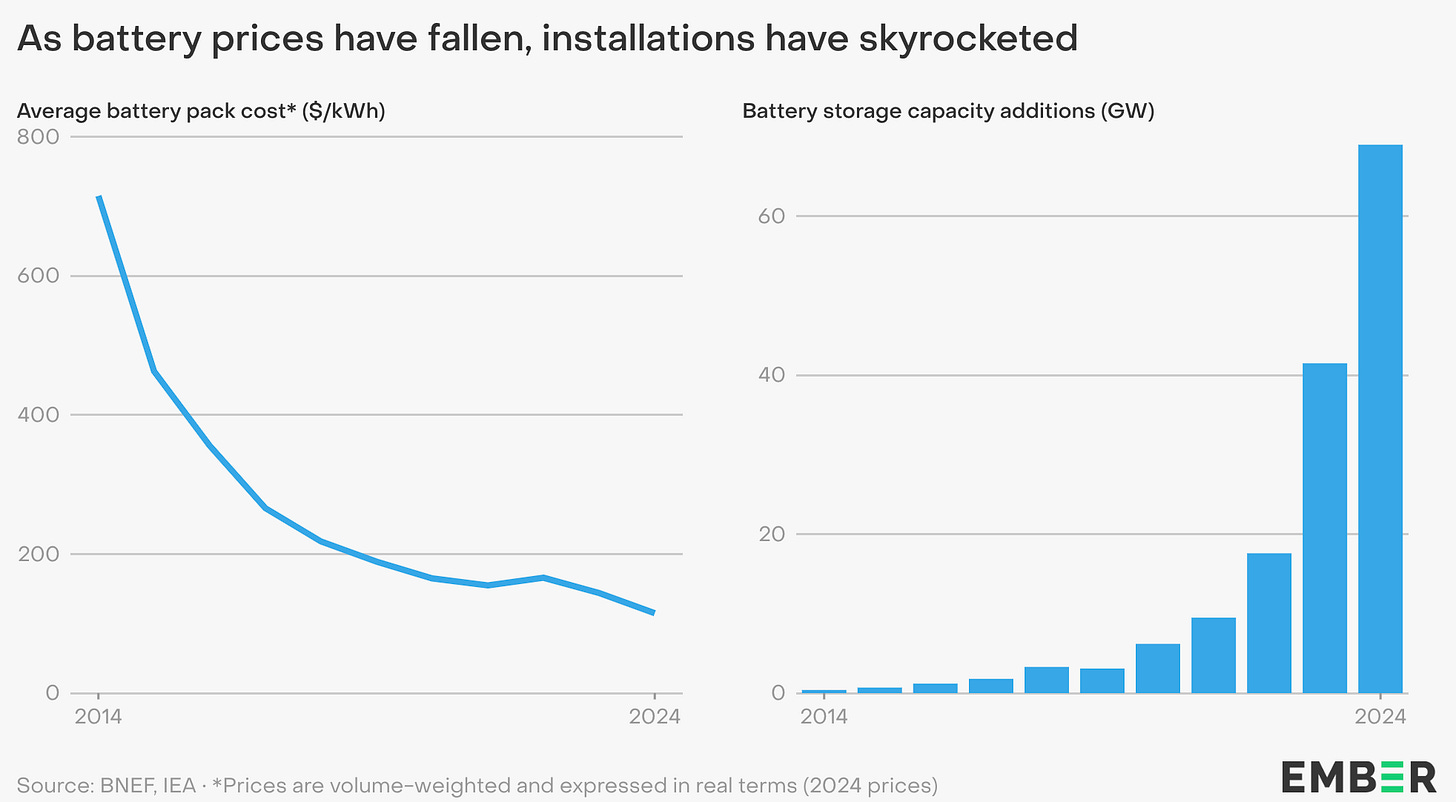

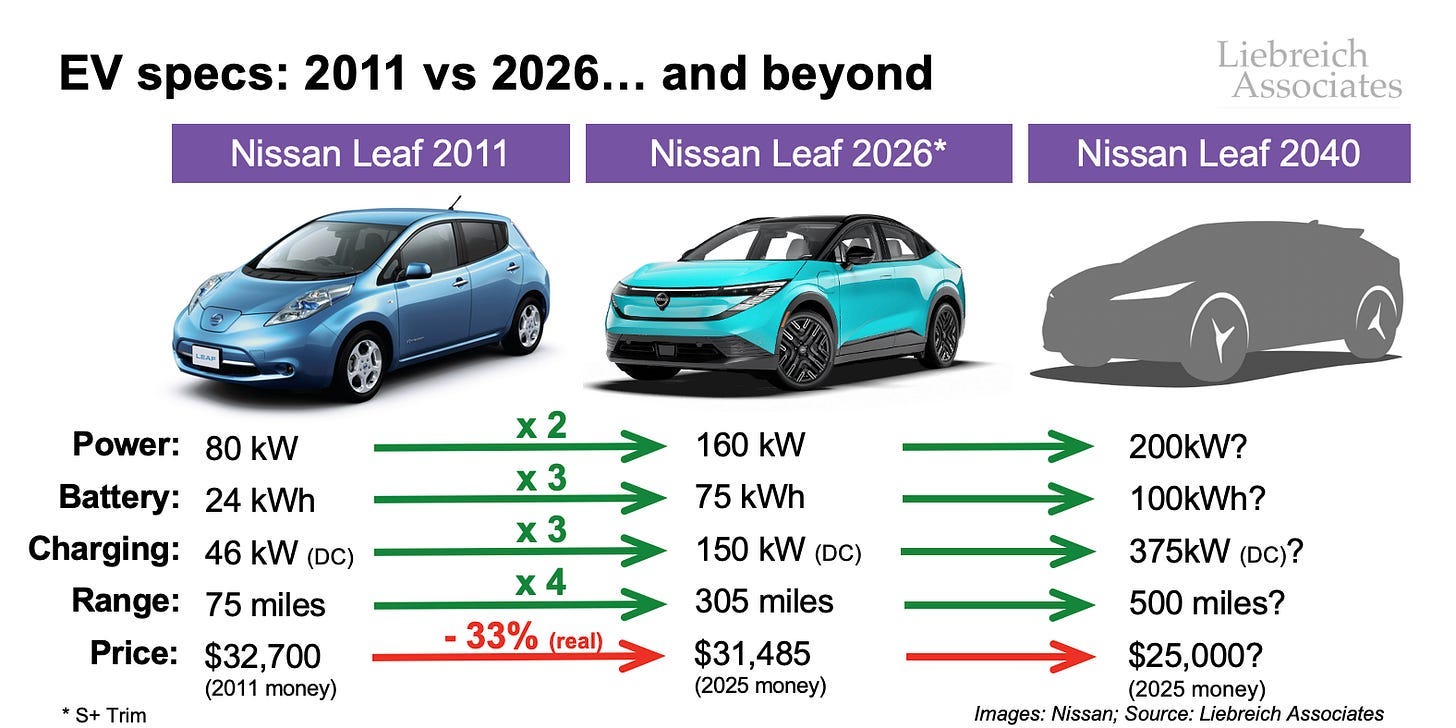

Meanwhile, batteries were previously too expensive to pair with them, but are a crucial addition to the system as they can store power generated during favourable weather conditions, and deliver it when demand rises above supply. However, batteries too have followed a learning curve, falling in price by 19% with every doubling of capacity, and they are now exploding in deployment as a result (53% growth in 2024, and the same again in H1 2025).

Speed, Power

This has helped unlock lower EV prices, in the same way that better battery technology also paved the way for the iPhone. Cheaper, with faster re-charging and longer range, EV’s have come a long way from Tesla’s early breakthroughs. They too are growing exponentially, following the S-Curve model for now, especially in certain countries (Norway, China).

From Horseless Carriage to Petrol-less Car

The S-Curve predicts that once a new technology hits 5% market share, it will rapidly accelerate towards 50% or beyond, before plateauing at its natural limit. This is because reaching 5% is so incredibly hard that technologies which reach that point have typically done all of the product development, refinement, market research, innovation, and cost reduction needed to dominate the market. They are typically already a superior product by the time they get to 5%, because they are taking market share from recognised market leaders with advantages like favoured brands, economies of scale, and established distribution networks.

To win that first 5% market share doesn’t sound like much when new people first hear about it, and when incumbents have 95%, but it’s by far the hardest part of the journey, especially in industries with deeply entrenched incumbents. Uber, Netflix, Spotify, and others have all proved this out, moving quickly to market leadership after breaking the 5% barrier. After 5%, learning curves are joined by economies of scale, social proof, and the diffusion of innovation.

This is not just a theory about how solar and wind will or might grow. It’s well underway already. Solar took 8 years to get from 100TWh of power to 1,000TWh, and then just 3 years to reach 2,000 TWh. Wind turbines have increased in size (rotor diameters now exceed 300 metres) and capacity, with a single one now able to power more than 150,000 homes.

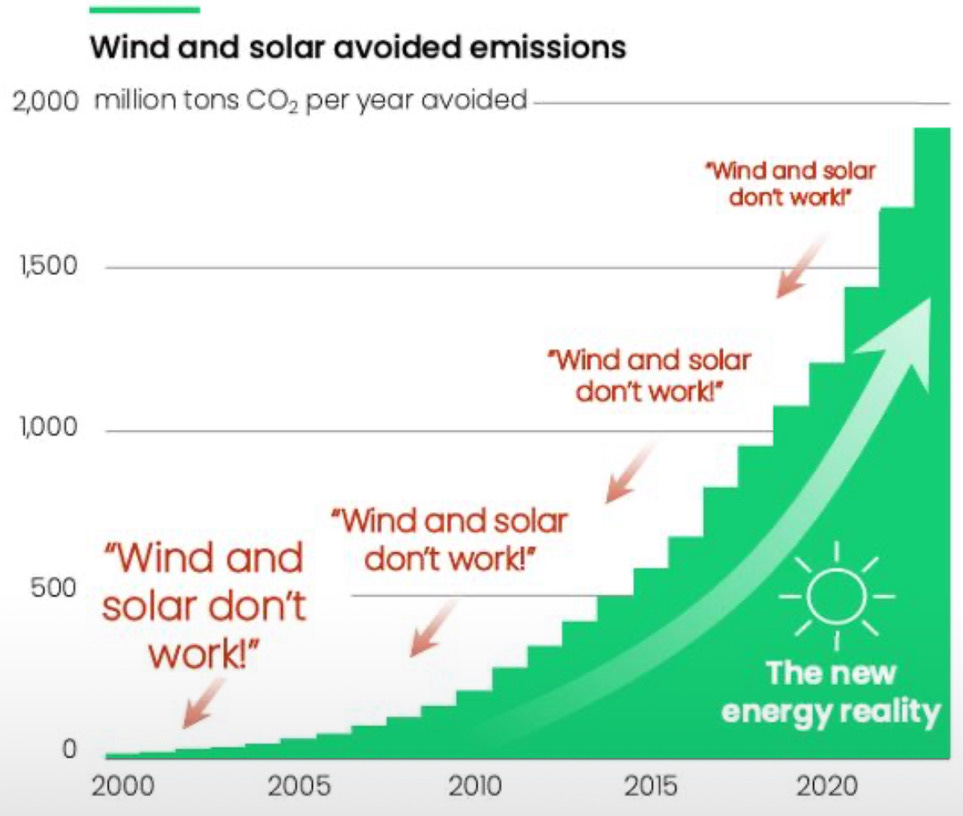

As this chart shows, solar and wind are growing exponentially.

Market Share Monster

We’ll get into the shape of the transition more later on, but the point is that solar, wind, batteries, and electric vehicles have reached significant scale already, and continue to grow at high rates, while fossil fuels, nuclear, and hydro area generally stagnating or declining.

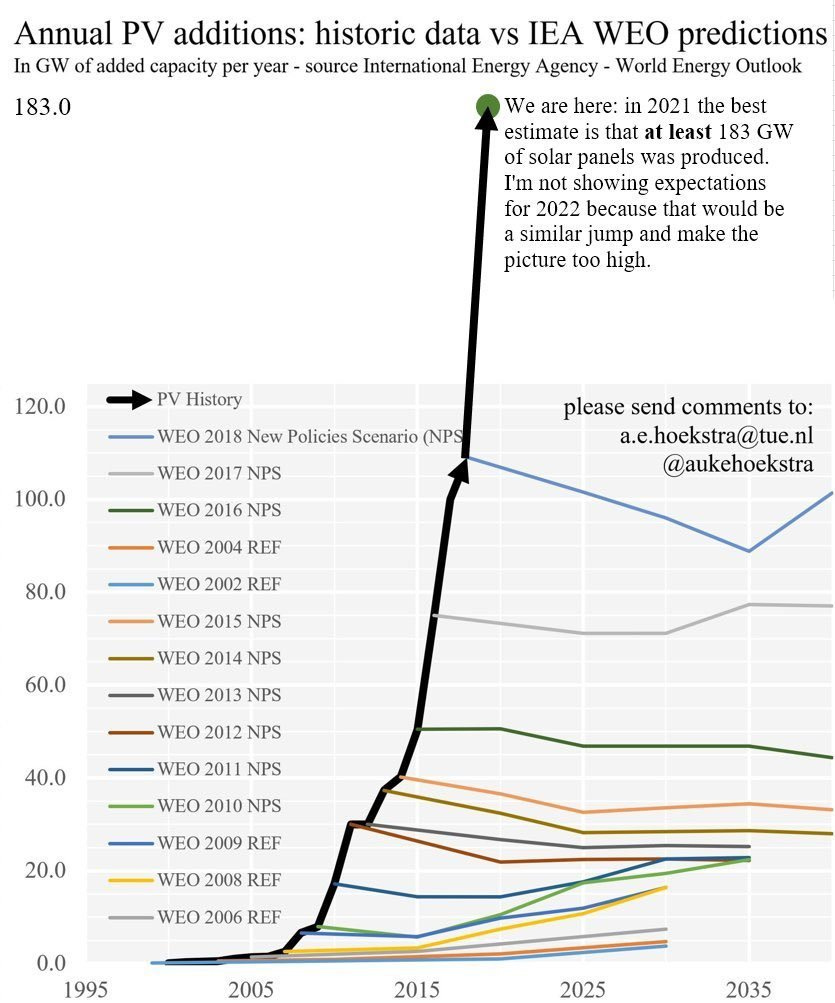

Moreover, they are doing so in the face of highly advanced, intelligent, well-informed, and completely wrong forecasts. These were by major, authoritative bodies like the International Energy Agency (IEA). The coloured lines show their forecasts each year, the black line showed what really happened.

Oops

That chart shows progress up to 2021, when 183GW of solar capacity was installed. In the three years since, the world has installed: 243 GW, 447 GW, and 597 GW (2024). Growth is not a possibility, it is a reality.

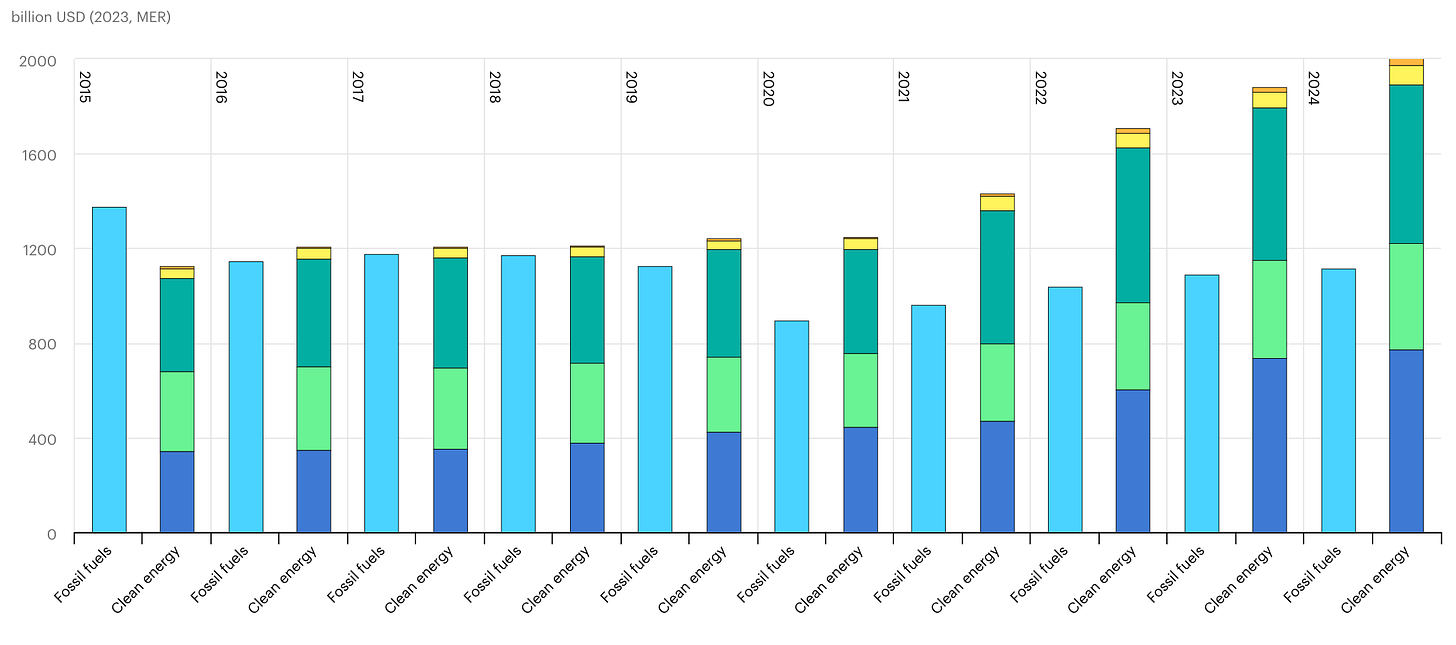

Behind all this are trillions of dollars in investment. Last year, clean technologies received over two of the three trillion dollars in total energy investment, i.e. more than double fossil fuels. This is split between renewables, grids and storage, and energy efficiency.

Follow the Money

These core technologies are getting bigger, better, and cheaper. That’s the story, and that’s the investment opportunity. To those who still protest, I leave you with this:

Climbing a Wall of Worry

What next?

In summary, there are three key points to frame this project.

There is a serious problem, that’s getting worse, and humanity is likely to be better off if it tackles it in the fastest and most cost-effective way. Not doing anything about it would be worse than doing something, and doing expensive/ineffective things is also detrimental.

The energy transition is a trend driven by technology and economics, and is the key tool in the fight against climate change. Within the energy transition, there is the shift to renewables which is decarbonising electricity supply, and there is electrification, the shift of fossil fuel applications to electrified demand.

A select number of new technologies are following patterns seen in previous technological disruptions, where each unit of growth lowers costs and improves performance, attracting more customers, creating a virtuous cycle, or feedback loop, which drives adoption patterns like the S-curve.

What all this adds up to is that the world is undergoing a systemic transformation in the way it generates and uses energy, faster than it has ever done so before, spurred on one side by the urgency of the climate crisis, and on the other by maturing disruptive technologies.

We are moving from a commodity-based system where burning fossil fuels was the best way to generate and convert energy, to a technology-based system.

The implications of this for investors are broad and significant, and it is the aim of this project to map them out, starting by looking backwards and learning from past energy transitions.

Starting next week.

Cheers for this piece, the 'worse than you think, better than you realize' vibe realy hits home. Any thoughts on how tech can help us move past the ESG hype into actual investment that sticks?

Always great to read a piece on ET that starts with a positive/hopeful message!